Stripe Connect makes YOU

liable for fraud.

Beat the fraudsters

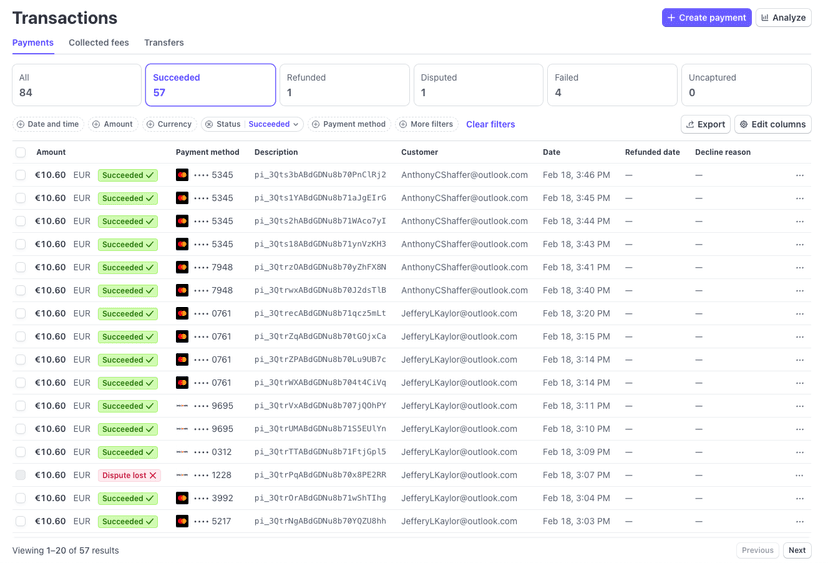

Stop seeing this in your Stripe dashboard

Every chargeback comes out of your pocket. GuardYourConnect spots fraudulent sellers before they drain your revenue💰

See GuardYourConnect in Action

Watch how GuardYourConnect helps marketplace owners protect their revenue from fraudulent sellers

Built by a Marketplace Expert Who Got Burned by Fraud

Here's my story and why I built GuardYourConnect to protect marketplace owners like you.

Hi, I'm Rasmus 👋

I've built 4 online marketplaces over the past few years, each teaching me valuable lessons about the marketplace ecosystem.

My marketplaces include a marketplace for Moomin mugs, a marketplace for podcast ads, a platform for turning homes into co-working spaces, and a marketplace for buying and selling stars.

All of these platforms were built on Stripe Connect - because honestly, it's the best way to handle payments between multiple parties in a marketplace.

💸 Then fraud hit me hard:

One or two fake sellers created accounts on my marketplace and rapidly processed dozens of transactions using stolen payment methods. Even though I caught it relatively quickly and most transactions were cancelled, the damage was already done. I got stuck with €800+ in chargebacks and fees because Stripe held me responsible as the platform owner.

That's when I realized: every marketplace owner using Stripe Connect faces this exact same risk. So I built GuardYourConnect - the fraud detection tool I wish I had when those sellers cost me €800+.

The Hidden Risk Every Stripe Connect Marketplace Owner Faces

Understanding your liability as a marketplace operator is crucial for protecting your business from unexpected costs.

⚠️ You Are Liable for Chargebacks

When fraudulent sellers join your Stripe Connect marketplace and customers dispute charges, YOU pay the chargebacks and fees - not the seller.

🛡️ That's Why You Need Fraud Protection

GuardYourConnect helps you detect and block fraudulent sellers before they can process payments and stick you with expensive chargebacks. Prevention is always better than paying for damage.

Stripe Connect Terms

Marketplace owner liability documentation

Click to view full size

🎯 The Solution

See exactly how GuardYourConnect protects your marketplace from fraud in 4 simple steps.

See How It Works

Everything you need to protect your marketplace

See how GuardYourConnect protects your marketplace from fraudulent sellers and costly chargebacks.

Click to view dashboard in detail • Use arrows to see different views

Fraud Detection

Review seller accounts, transaction patterns, and risk indicators to identify potentially fraudulent accounts before they can cause damage.

Detailed Risk Analysis

Get comprehensive reports on high-risk sellers with actionable insights. See exactly why a seller was flagged and what actions to take.

Take Action Immediately

Block suspicious sellers, review flagged accounts, and protect your marketplace from fraud before chargebacks occur.

Get Instant Alerts

Receive immediate email notifications whenever a high-risk seller joins your marketplace. Stay informed and act fast.

Ready to Protect Your Marketplace?

Join marketplace owners who are already protecting their revenue from fraudulent sellers and costly chargebacks.

Choose the right plan for your marketplace

Protect your Stripe Connect marketplace from fraudulent sellers and costly chargebacks with this comprehensive fraud detection solution.

Monthly

Perfect for getting started with fraud protection.

- Real-time fraud detection

- Risk scoring for all sellers

- Seller monitoring dashboard

- Email alerts for high-risk activity

- Basic fraud reports

- Seller onboarding verification

- Account completion tracking

- Transaction pattern analysis

🔒 Secure payments powered by Stripe • 30-day money-back guarantee

Yearly

Best value - save $99 annually with yearly billing.

Save $99 compared to monthly billing

- Everything in Monthly

- Advanced reporting & analytics

- Bulk seller management

- Priority email support

- Data export capabilities

- Early access to new features

- Annual billing discount

- Access to Discord channel

🔒 Secure payments powered by Stripe • 30-day money-back guarantee

Frequently Asked Questions

Get answers to common questions about GuardYourConnect and how it protects your marketplace

GuardYourConnect is a specialized fraud detection tool designed specifically for Stripe Connect platforms.

It monitors your connected accounts and transactions to identify suspicious patterns, fraudulent behavior, and potential risks that could lead to chargebacks or financial losses.

Think of it as your personal fraud analyst that watches your platform 24/7, alerting you to issues before they become costly problems.

Thereby saving you lots of money.💰

When you use Stripe Connect, you agree to take full liability for all disputes, chargebacks, and fees from your connected accounts - even if they're caused by fraudulent sellers on your platform. (see terms below)

This means every chargeback could cost you $15-30 in fees plus the transaction amount, and sophisticated fraudsters specifically target marketplaces because they know platforms (you!🫵) bear this financial risk.

With the rise of AI tools, these attacks are becoming more sophisticated and frequent than ever before.

GuardYourConnect solves this by detecting these bad actors before they can cause expensive chargebacks, protecting your business from unexpected financial losses.

These are the terms you agree to when you use Stripe Connect:

GuardYourConnect detects several specific fraud patterns that target marketplaces. Among many other sophisticated attacks GuardYourConnect detects:

• Duplicate Account Fraud: Multiple accounts using the same email domain or similar names - often used by fraudsters to create backup accounts

• Fast-Charge Attacks: High-value transactions (€500+) processed immediately after account creation, or suspicious volume spikes (€5000+ in 24 hours)

• Dormant Account Risks: Accounts that complete onboarding but show no genuine business activity - potential shell accounts

• Incomplete Onboarding: Abandoned accounts that may be testing your platform's security or preparing for future attacks

• And many more! sophisticated fraud patterns as they evolve

Each detected pattern gets a risk score (1-10) and accounts are flagged as low, medium, or high risk so you can prioritize which sellers need immediate attention.

You'll start seeing fraud detection insights immediately.

The system begins analyzing your Connect data right away and identifies suspicious patterns across your platform.

Most customers see a significant reduction in fraudulent activities within the first week as they take action on the high-risk accounts that are flagged.

The real cost is much higher than most people realize. According to Stripe's own research, businesses end up paying $3.75 for every $1.00 in chargebacks (LexisNexis report).

Beyond the lost transaction amount, you also pay $15-30 per dispute in fees, plus internal processing costs. For Connect platforms, this can be even higher due to the complexity of multi-party transactions.

The problem is massive: ecommerce businesses were projected to lose roughly $20 billion in 2021 due to fraud - an 18% increase from $17.5 billion in 2020. And with the rise of AI tools making fraud more sophisticated, this problem is only getting worse.

GuardYourConnect helps prevent these costly disputes before they occur by identifying suspicious patterns early.

There's no free version, but the pricing is incredibly affordable compared to the cost of even a single chargeback!

We offer two simple pricing options: $29/month for ongoing protection or $249/year for the best value with annual billing. Both plans include full access to all fraud detection features, real-time monitoring, and detailed reporting.

Consider this: just one chargeback could cost you $100+ when you factor in fees and lost revenue. GuardYourConnect pays for itself by preventing even a single fraudulent chargeback.

No hidden fees, no transaction-based charges - you pay one price regardless of your platform's size or transaction volume.

Stripe Radar focuses on general payment fraud across all transactions, while Radar for Platforms is still in private preview (not publicly available yet) and is designed for larger companies with big operational teams.

GuardYourConnect is different - with this tool, you'll be notified every time a high-risk seller joins your marketplace, so you can take action quickly and not lose money to fraudulent chargebacks.

Think of it this way: Stripe's tools are great for blocking stolen credit cards, but GuardYourConnect catches the sophisticated fraudsters who specifically target marketplaces because they know you pay for their chargebacks.

Absolutely. GuardYourConnect is designed with minimal data storage in mind.

What I DON'T store: Your marketplace's transaction data, seller personal information, or payment details are never permanently stored on my servers.

What I DO store: Only essential account information (your email, platform connection status, and account notes you create).

How it works: All fraud detection operates in real-time by analyzing data through Stripe's API. Transaction and seller data is processed temporarily for risk assessment but nothing sensitive is kept.

Your data stays secure with industry-standard encryption, and payment processing is handled entirely by Stripe (which is PCI DSS compliant).

Still have questions?

Just send Rasmus an email!

“I have experienced fraud on one of my own marketplaces - and I know how it feels.”

- Rasmus